Field management software provider Re-flow has released the State of the Construction Industry Research Report 2024, which explores the recent problems challenging the industry – from strained relationships with the government to the skills shortage

State of the Construction Industry

According to the Construction Products Association (CPA) in January, the construction industry ‘experienced an acute recession last year’. This was ‘driven by double-digit falls in the two largest construction sectors: private-housing new build and private-housing repair, maintenance, and improvement.’

The industry consensus appears to suggest more hard times are on the way. The main positive news centres around an easing of inflation in some material types and a small increase in detailed planning approvals.

The country as a whole made a strong initial leap towards lowering carbon emissions, mainly by nearly completely eliminating coal as a source of energy and replacing the supply with renewables. In the construction industry, we have an opportunity to continue the country’s progress.

Other headlines:

- The sector’s struggles with recruitment continue.

- Glenigan’s market analysis noted a decrease in contract awards and starts, in line with a long-term downward trend.

The Bank of England’s most recent update to the Agents’ Summary of Business Conditions in March read:

- Construction output volumes continue to fall.

- Most now anticipate sentiment to begin to improve in the latter part of the year, although, as in other sectors, this is contingent on reductions in Bank Rate.

- The number of new orders remains weak.

- Concerns about insolvency risks remain high and continue to delay current and new development schedules.

- House building has fallen markedly over the last year, although the pace of decline is slowing.

- Commercial development continues to stagnate, though not to the extent seen in the housing sector.

- The infrastructure sector has seen more deferrals and cancellations of large new projects.

- Those contacts with projects that already have consent may see a pickup late in the year.

- Contacts cite slow and increasingly complex planning applications and approvals as a likely drag on the pace of growth.

Output and Activity

After a long-term reduction in their income, local authorities have seen their planning departments’ capacity decline. The knock-on effect, according to the Construction Products Association, has been ‘a hold up of approvals on projects and a delay in getting spades in the ground.’

The spring budget announced measures designed to rectify the issue. In it, the government made a £3m commitment to match industry-led funding for a skills-and-education programme in order to attract workers to roles as local planners in planning authorities. The government also announced a pilot scheme to use AI to ‘speed up development of local plans’ and explore new software ‘to streamline key processes for planning officers’.

According to the most recent official data from ONS,construction output:

- Decreased in December, falling by 0.5% (SA). The three months to December saw a decrease in overall construction output of 1.3% (SA) and a 3.2% decrease on the previous year.

- In the three months to December, repair and maintenance output increased by 4.0% (SA) to stand 12.2% up on the previous year. Public housing RM&I increased by 8.3% (SA) with non-housing R&M increasing by 3%. Private housing RM&I increased 4.3% (SA) during the period.

- Overall new work output decreased by 5.0% (SA) during the three months up to December and decreased 12.6% when compared with a year ago. Public non-residential

(+0.3% SA) increased against the preceding three months, while infrastructure work (-7.5% SA) decreased. - Public new housing experienced a 1.5% increase (SA) with private new housing experiencing an 8% decrease against the preceding three months. Commercial (-2.3%) experienced a decrease against the preceding three months. Industrial experienced a 0.5% decrease against the three months to December.

The CPA made their own suggestions for improving the situation:

- Focus on repair and maintenance. By focussing on ‘near-term basic repairs and maintenance that have a quicker turnaround, the UK economy and productivity could enjoy an immediate and obvious return on investment…along with a sizable stimulus for the sector.

- Make available more investment for transport work such as bridge and road repairs’.

- Recognise that the poor condition of the public estate could have been avoided by funding regular maintenance properly.

Cash Flow/Funding

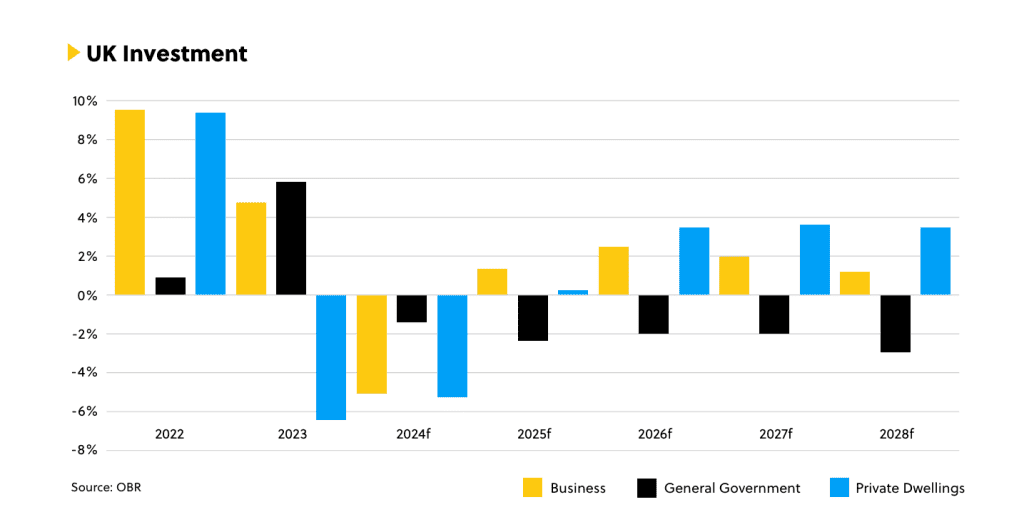

With inflation slowing, the next few years should see a real-term improvement in the growth of the economy. As per the Office of Budgetary Responsibility, increased consumer and government spending will be the main drivers of this upturn.

Fixed investment is forecast to drop by 5.4%. Business and public sector investment are set to decline, together with a 5.3% drop in private-dwelling investment.

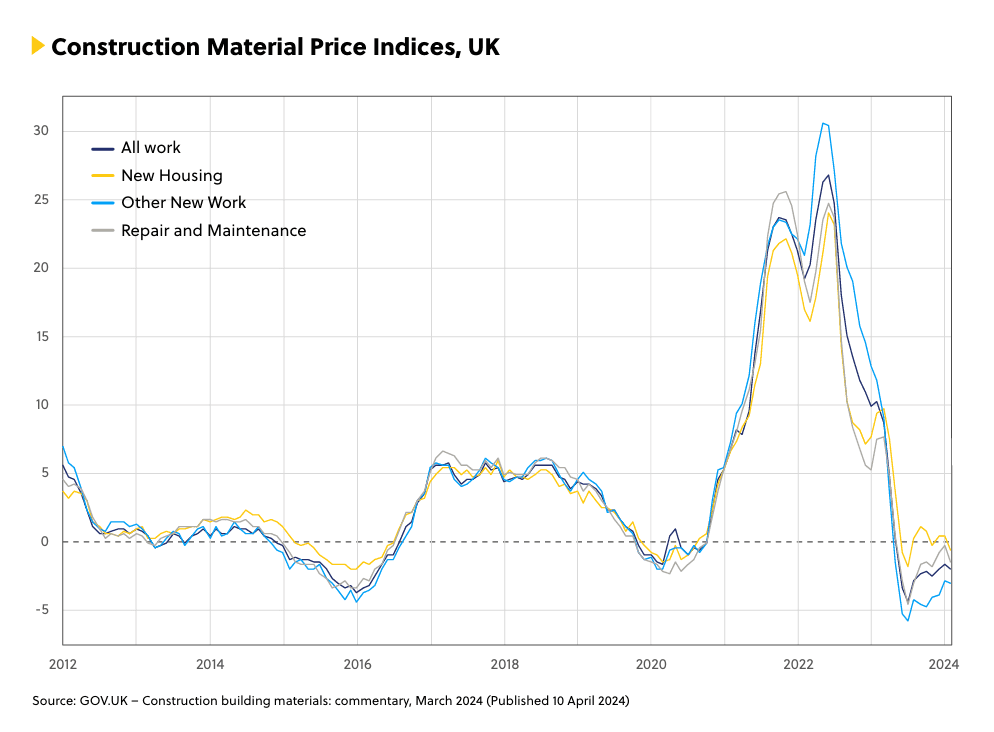

Back in January, the CPA were quoted as saying the cost of construction materials is projected to rise by 5.9% in 2024, which is more than the expected inflation rate.

Analysis

April’s figures showed a slower-than-expected drop in inflation. Andrew Bailey, governor of the Bank of England, said that the disinflation fall was unbalanced. ‘In April household energy bills were likely to be 25% lower than a year earlier, but service sector inflation is running at 6%.’

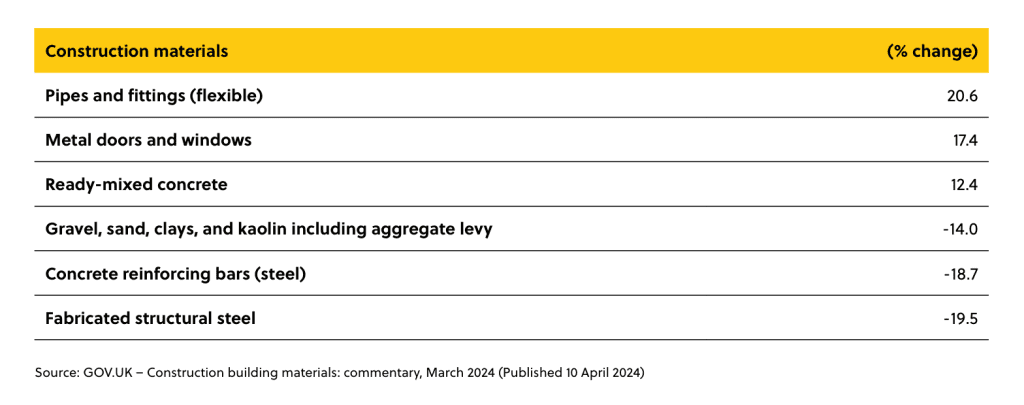

Different materials have been experiencing different shifts in price. Government statistics cover the 12 months up to March 2024:

Different materials have been experiencing different shifts in price. Government statistics cover the 12 months up to March 2024:

Cancellations and Delays

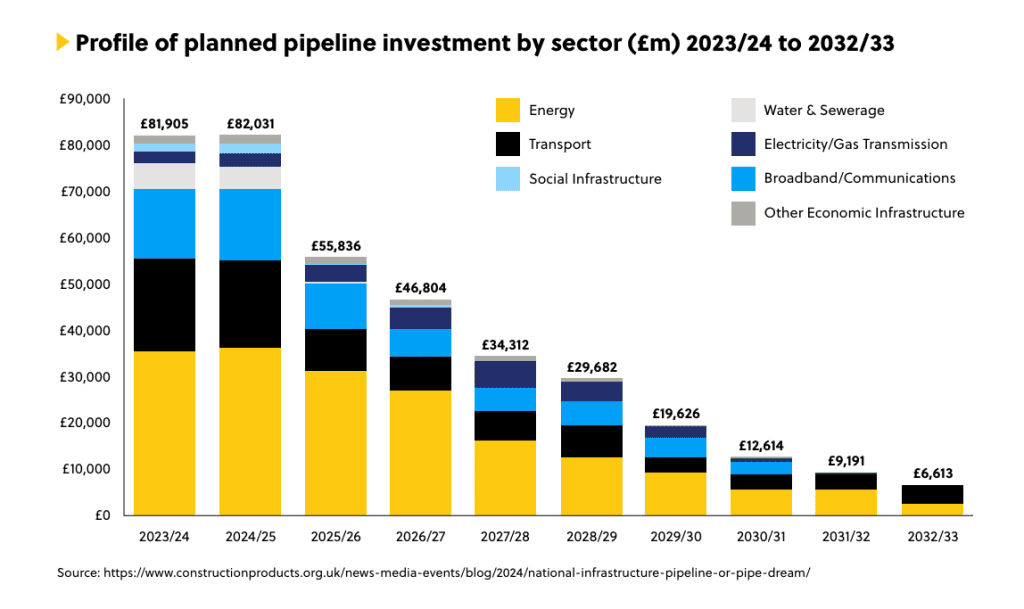

The National Infrastructure and Construction Pipeline, published in 2021, announced a number of projects and programmes that have now been delayed and cancelled including HS2 between Birmingham and Manchester.

CPA analysed the situation: ‘It’s important to note what’s going on with spending on these projects. Although the government will declare that the value of the pipeline has increased from £650 billion to £700-775 billion, it is in fact more PR. Although spending has gone up, most of this is due to increased cost of infrastructure construction since the last pipeline and government has still nevertheless cancelled and delayed an array of projects the last two years.

‘Can the construction supply chain (architects, consultants, contractors, merchants, and product manufacturers) justify large investment upfront (in skills, capacity, digitalisation, and modern methods) for a long-term rate of return based upon the Pipeline? If firms in the supply chain do make those large investments, how can they know for certain whether they would be lumbered with high-cost assets and skilled workers that are not utilised? Given the constant delays, pauses, and cancellations we’ve seen in recent years, those firms would be forgiven for having some reasonable doubts.

‘Conversely, if firms don’t make the large upfront investments due to the risk of delays and cancellations to major infrastructure projects, there will be a lack of capacity and skills. This would either make large infrastructure projects substantially more expensive or financially unviable without substantial government subsidy.’

The following have been promised:

- £600 billion of planned public sector investment over the next five years.

- £7.2 million to unlock improvements to local transport connections between the Cambridge Biomedical Campus and the city.

- Delivery of works on the Bletchley to Bedford section of East-West Rail will be brought forward.

- Upgrading the timetable on the East Coast mainline.

Skills and Recruitment Shortages

According to recruitment agency Search Consultancy, the

main driver of shortages in the industry is a lack of recruits

(36%) followed by an issue with retaining staff (25%).

Brexit has had an impact. P.I.E.R wrote, ‘Figures collated by the ONS suggest that until the end of 2020, over 9% of the construction workforce in the UK were EU nationals. In London, this rose to 30%. Now, it’s harder than ever for EU nationals to work in the UK. In turn, this is likely to create longer term impacts for the industry, including delays on projects due to staff shortages, and higher costs thanks to a dwindling workforce.’

Coupled with this, a shifting attitude among younger citizens is adding depth to the recruitment sea change. This generation are more drawn to tech-based jobs.

Daisie Rees-Evans, policy development manager at the Chartered Institute of Building (CIOB) commented: ‘There is an ageing workforce, particularly in the South West, which will impact knowledge sharing and project timelines if there isn’t ‘succession’ in place for new talent entering the industry.

‘Research by CIOB suggests only a third of consumers would recommend the industry to their child or a young person they know. There are issues with the perception that construction is low-paid, dirty, and for people with poor academic skills.’

However, a fifth of construction professionals believe a shortage of technology and digital kills is the reason for construction talent shortages.

Investing in Change – ‘Secure Technical Skills for Future Green, Digital Jobs’

As reported in PBC Today, Adrian Attwood, executive director of DBR Limited, said, ‘Investing in skills needs to become a priority for the UK construction sector, particularly in specialist professions. Niche roles from conservation stonemasons and master jointers to leadworkers, gliders, and cleaners are at significant risk as talent pools continue to shrink.

‘With the economy starting to stabilise and an upcoming election providing an opportunity to press the reset button on the education system, I hope that policymakers and the industry can come together to develop a deliverable strategy to overcome the acute human resource shortages we’re currently experiencing.’

The CPA and Make UK have called for the government to introduce apprenticeship incentives for areas of skill shortages, and to allow greater flexibility for how and when manufacturers can spend their apprenticeship levy funds. The aim is to ‘boost the quality and quantity of apprenticeships, [and]… to invest in the green, digitised jobs of the future.’

Elsewhere, the CPA suggested that ‘committing to continue the finding of traineeships is another important requirement to attract more talent into the industry.’ What’s clear is that more focus needs to be placed on developing a forward-thinking working skills policy.

The Future of Office and Site Work

The situation of a lack of talent leading to delays and further spiralling costs is leading to companies intensifying efforts to attract and retain skilled labour via competitive wages and training programmes to bridge the skills gap.

This January, in a report focussed on scaffolding, Trade Solutions UK wrote, ‘Demand has severely outpaced supply for years now, and relief is still years away as newly trained workers attempt to backfill a deep deficit. This persists, even as improved wages, benefits packages, and terms of work continue to improve. Companies must get more creative with recruitment tactics. With skilled labour remaining hard to find, new tactics must be deployed to qualify and employ the correct labour. Site supervisors are being placed under immense pressure to increase work hours and get the job done. It must be remembered that safety comes before the project, not the latter.’

Net Zero and Sustainability

The CPA stated that the UK will not reach its 2050 Net Zero promises without refurbishment of the existing housing stock, and that industry patience with the government is wearing thin. ‘Our members say that the constant changing of direction and the lack of a consistent policy framework around energy efficiency has been frustrating and counter-productive,’ the CPA wrote. ‘Particularly around future-homes standards and minimum-efficiency standards. As businesses, many have made long term, multi-million-pound investment decisions on the basis of previous commitments only to suffer losses when those commitments change. This has served to undermine the Government’s credibility.’

The CPA have a very specific vision. They suggested that infrastructure projects should be procured not just on cost but also by recognising the value of sustainability –environmentally, economically and socially. ‘Government departments must be seen to embed ‘whole life’ values into their procurement decisions,’ the CPA wrote. ‘UK construction product manufacturers should…invest significant resources into reducing the

environmental impact of their products and materials, providing third party accreditation and undertaking local hiring, training, and supply chain initiatives that have a meaningful impact on their communities. In addition, procuring for value should ensure that concepts around greater safety are embedded and help avoid poor performing substitutions. Such work and expense are not undertaken here by most overseas companies that simply import into the UK, and this should be taken into account during the procurement process.’