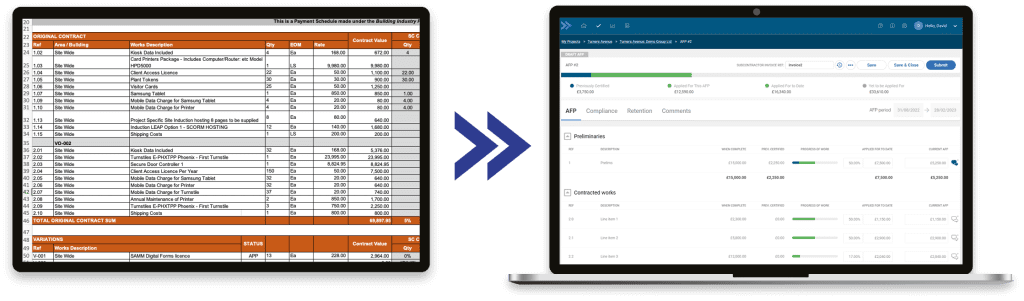

Contractors and subcontractors submit, manage and certify applications for payment on a regular basis. However, many are still using spreadsheets to manage the process, despite there being other more accurate and cost-effective automated alternatives

With rising consumer confidence and falling inflation, the Construction Industry Training Board (CITB) has suggested that the UK will require more than 251,500 additional construction workers by 2028 to meet growing demand, so embracing technology to ensure more efficient working practices and less wasted time on administration is becoming essential.

Switching from manually inputting application for payment data into spreadsheets to more modern practices that utilise innovations in technology, such as Payapps automated software, will not only cut out inaccuracies, but will also reduce administration time and ensure an easy-to-follow audit trail for comprehensive recordkeeping.

No payment calculation errors

As stakeholders add more data, spreadsheets get larger, and the number of formulas and formats increase. Errors or inaccuracies are inevitable and it’s easy for these to be missed when spreadsheets are rarely subject to meticulous checks. Additionally, payments and valuations are very easy to get wrong, leading to over- or under-spending, project delays or disputes.

Payapps software ensures standardised and automated calculations, saving time, increasing accuracy and reducing risk. Having one set of numbers approved and time-stamped, for both contractors and subcontractors, also makes it quicker to authorise. The reduced risk of disputes also means projects will more likely be completed on time and to budget.

No missing files or accessibility issues

Inconsistently named spreadsheets can get lost in email inboxes and multiple filing systems. Hours are wasted hunting for them – time better spent on core business activities.

Similarly, applications for payment can often sit in a quantity surveyor’s inbox until they make the assessment, meaning nobody else knows what’s come in. This could prove a problem if that person is away from the business for any period of time – not having quick access to the required information can lead to missed payment notice deadlines, leaving the relevant party non-compliant.

Offering real-time visibility as soon as a subcontractor submits an application for payment via the shared software platform, Payapps makes it quick and easy to track and monitor payment status.

Cloud-based, it enables secure access to data and information from any device. With built-in reminders, Payapps allows all involved to keep on top of deadlines and remain compliant with the UK Construction Act.

An easy-to-follow audit trail

The sporadic and manual updates associated with spreadsheet-based applications for payment can make it difficult to track changes. For instance, it can be hard to monitor who made the last change, what that was, which is the latest version of the application, and who owns it.

A detailed action history of individual applications for payment with timestamps of when an application was created, submitted and assessed enables confident decision-making.

Furthermore, it contains all supporting documentation, including commentary exchanged between the contractor and subcontractor.

Standardised formatting for applications and variations

With many subcontractors preparing and submitting applications for payment in different formats, it can be a headache for quantity surveyors to work through them to ensure the correct information has been provided. Any errors or omission at this point can result in underpayments, overpayments or disputed figures, costing time, money, and more hassle.

Enabling subcontractors to submit applications in the agreed standardised format within a centralised platform, Payapps allows teams to know what to expect, speeding up administration. It also ensures subcontractors adhere to what was agreed in the contract. Additionally, there will be clearer governance of how variations are categorised, avoiding discrepancies.

Accurate and simple status reports

With so much spreadsheet information, it can be difficult to make sense of all the data, leading to a lack of meaningful analysis. Payapps, however, enables colour-coded, at-a-glance views of project progress and the application for payment status to ensure accurate, and fast decision-making.

Having centralised, easy-to-share information means contractors can quickly see with whom the application is sitting and track payment notice deadlines, while subcontractors can view application status. This common understanding of the real-time status of payments is essential for accurate projected final accounts and cashflow reporting.

Save time and hassle

Too much time can be spent updating, consolidating, modifying, and correcting data in spreadsheets. It can often also be difficult to share the spreadsheet data internally or with the supply chain, meaning contractors spend time responding to enquiries about payment application status.

The automated calculations and workflow functionality in Payapps ensure accuracy, reduce risk and save vital time. Able to send automated reminders of applications due to subcontractors, this innovative software removes the need for commercial staff to do this themselves.

Automated payment software also offers increased security

With spreadsheets being able to be sent to anyone, and opened by anyone, there is an increased risk of security and potential data breaches. They are also likely to be manually passed through multiple emails and people for sign-off.

Payapps, on the other hand, has achieved ISO 27001 certification, providing peace of mind that applications remain in a safe and secure environment. All information is stored securely in AWS data centres and backed up, ideal for retrieving information as evidence during dispute negotiation and audits.

For added security, Payapps features Optional SSO (Single Sign-On) for working across multiple resources with a single authentication and Multi-Factor Authentication.

As a cloud-based system that makes submitting and certifying applications for payment faster and easier, isn’t it about time your business stepped away from the old-fashioned use of spreadsheets to Payapps software, and improves the collaboration with your subcontractors?

Download a quick reference eGuide to compare spreadsheets and Payapps side-by-side.

*Please note that this is a commercial profile.

![[VIDEO] Making DorTrak reports easy to read with Fireco Inspecting fire doors at Fireco, firedoor technology, 2023](https://www.pbctoday.co.uk/news/wp-content/uploads/2024/04/JPZ_2364-web-218x150.jpg)

![[VIDEO] Re-flow Field Management review by Traffic Management Installations When TMI began subcontracting for councils and government bodies, they wanted to present their site reporting in a more professional manner](https://www.pbctoday.co.uk/news/wp-content/uploads/2025/03/TMI-Media-1-218x150.png)