A new report, Laws of AI Traction, from law firm Dentons explores how the construction industry is getting to grips with artificial intelligence. Authors Akin Akinbode, Mark Macaulay and Tracey Summerell discuss its findings

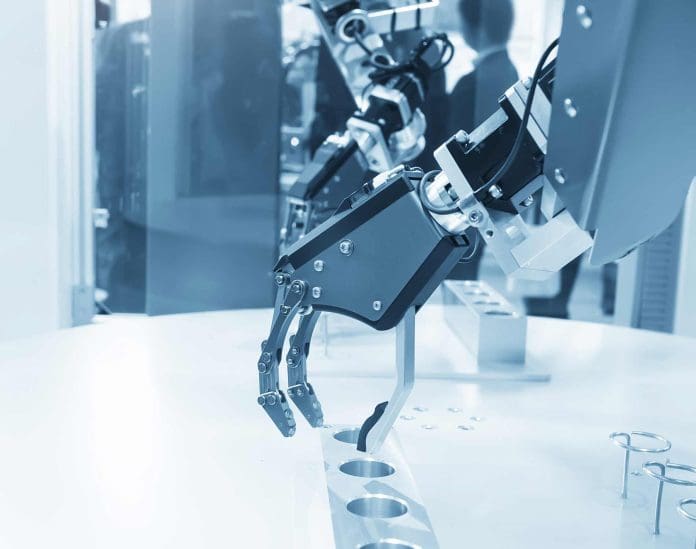

Artificial intelligence (AI), from generative AI to robotics, has the potential to transform many aspects of the construction sector.

Widely touted use cases include the possibility of creating better informed designs using analytics trained on increasingly large specialist architectural and engineering datasets; sophisticated 3D modelling capabilities; and autonomous machines that can improve site monitoring and safety.

Other areas where AI might prove helpful include reducing thefts from construction sites; streamlining project management; and improving transparency in a sector recently rocked by scandals and routinely engaged in disputes over the performance of building materials.

But, as an industry that operates on tight margins, and with more immediate and expensive issues to resolve such as building safety, skills shortages and cost inflation, construction has not so far not been among the trailblazers in developing new AI applications.

To date, the sector has predominantly deployed AI for peripheral support services, rather than core operational functions.

Laws of AI traction report

According to a recent survey by Dentons, the most popular use cases for AI by real estate developers and construction companies include IT and cybersecurity, with 75% of sector respondents saying they already use AI for this purpose, followed by customer service and

accounting – both at 71%.

However, the industry recognises that it needs to get to grips with AI to avoid missing out on the benefits the technology offers.

According to Dentons’ survey, more than half (54%) of sector respondents said they believed failure to increase investment in AI in the next 12 months would result in increased risk of data breaches, while a similar number (52%) feared this would result in workforce skills shortages.

Setting data security aside, which is acknowledged as a major risk area for all sectors, the digital skills issue is a significant risk for construction as an industry already struggling to fill vacancies for skilled manual trades.

Because the construction industry is characterised by a vast range of skills and roles, it is difficult to generalise about how AI will affect the sector. However, it is generally assumed that generative AI will have the greatest impact in ‘desk-based’ roles such as architecture and engineering.

More manual occupations await the advent of increasingly sophisticated robotics that can replace humans in dangerous construction site roles and reduce the downtime associated with human shift patterns.

Dentons’ survey findings suggest many in the industry are worried that their organisations lack the knowledge to effectively deploy AI in the areas where it could provide significant benefits.

Failure to harness AI carries attendant business risks, such as becoming uncompetitive against companies that do use AI for efficiency and productivity gains.

Construction firms that fail to deploy AI to improve safety, should this become common practice in the industry, might also leave themselves open to negligence claims.

This recognition does not solve the problem that most construction firms lack the spare capital and risk appetite to invest in buying in new AI tools or developing them in-house.

This situation is compounded by the fact that a large proportion of construction work is performed by smaller subcontractors, who often suffer from poor cash flow and have limited resources for research and development (R&D), meaning the sector as a whole will rely on the industry’s largest firms to take on the cost and risk of experimenting with AI, before adopting proven technologies at more competitive prices.

Ultimately, construction companies are looking for AI tools that deliver a clear margin benefit and/or competitive advantages, with very low risk of technological failure or obsolescence – a status construction-focused AI (with some exceptions) is generally yet to reach.

The future of construction-focused AI

While some AI R&D is underway, the technology’s experimental status means construction companies are generally more reluctant to deploy AI in higher-risk areas, such as supply chain management, preferring to roll out the technology in lower-risk service functions.

This is expected to change as construction-focused AI matures. However, and in the next five years, the sector could feasibly see robots carrying out several on-site activities and AI being incorporated into building products as well as becoming ubiquitous across many common construction industry processes.

These include: conducting analyses; selling and ordering products; coordination across teams and organisations; and making of strategic project management, design and experiential decisions.

Ultimately, AI will be able to do many of tasks humans do today, more quickly, cheaply and reliably. As with any new technology, there will be an adoption curve, but its use in construction is an inevitability the industry cannot escape, and must prepare for.