A new survey has revealed over 250,000 people have given up on the idea of homeownership, with increasing house prices and large deposits cited as the reason

The cost of housing and the availability of property is a major barrier for homeownership. According to a new survey the issue is so bad that over 250,000 people have given up on the dream.

The data collected for the 2017 Homeowners Survey revealed the stats, showing a high proportion of respondents no longer aspire to own property.

The study, carried out by the HomeOwners Alliance and BLP Insurance, found for the first time in five years there has been a decline in the number of non-homeowners wishing to get on the property ladder.

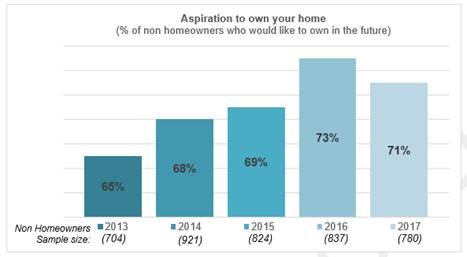

Figures in 2013 suggested 65 per cent of people aspired to own property. This figure continued to increase before peaking in 2016 when it reached 73 per cent. However, this fell to 71 per cent this year. This means around 253,166 people have given up on the idea of owning their own home in the past 12 months.

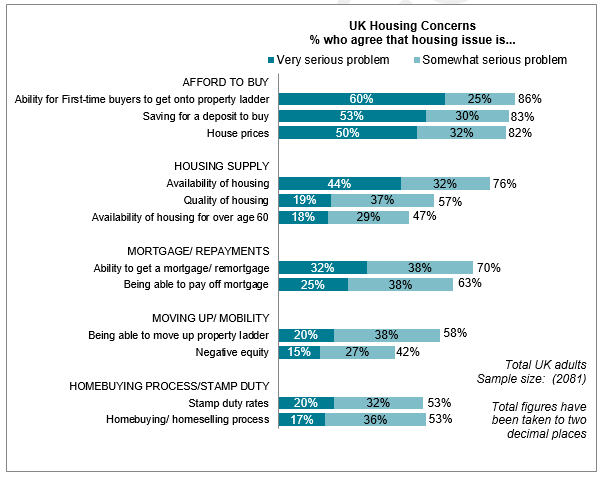

The survey also revealed concerns around house prices (86 per cent), saving a deposit (85 per cent), and the availability of homes (80 per cent)—all of which remain key issues.

Londoners remain the most concerned about house prices at 87 per cent, but Wales also matched this figure. Some 82 per cent of people in the South West said they were worried about the availability of housing—more than the capital at 81 per cent.

Housing remains a key concern

Paula Higgins, Chief Executive of HomeOwners Alliance said: “The HomeOwners Alliance has been tracking views of consumers for five years now, and these latest findings show that the housing crisis is deepening across the UK.

“This in turn is impacting on people’s aspirations to get on the property ladder. While we are used to stories about people not being able to buy a home until they are 40, the story has taken a turn for the worse with people increasingly giving up altogether on the dream of homeownership.

“While aspiring homeowners’ concerns about house prices, saving for a deposit and housing supply grow, the change in political rhetoric around homeownership and a lack of new homes being built in the last year, plus the removal of flagship government schemes like the Help to Buy mortgage guarantee, appear to have had a negative impact on consumer attitudes.

“People are feeling less optimistic about their chances of buying their first property.

“With the election approaching, it is vital that housing is placed at the forefront of the policy agenda and that whatever party is elected, it takes serious steps to address the growing concerns of aspiring homeowners.”

Kim Vernau, Chief Executive Officer of BLP Insurance said housing must remain a priority for government.

“The housing crisis is worsening across the country. We are failing to deliver the numbers of homes required as a direct result of a lack of SMEs to develop over and above the numbers provided by the large house builders.

“The recent housing white paper from the Government proposes a wide variety of recommendations to the market for consultation, to address issues with planning and resource, with a distinct shift away from focusing solely on home ownership. This is a tacit acknowledgment that not everyone will be able to own their home.

“It is important that post the election result, the provision of housing is seen as a critical requirement and the results of government consultations prioritised into action. In the absence of this, the opportunity for aspiring new home owners to get on the housing ladder will only continue to deteriorate.”