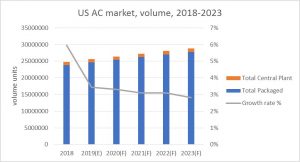

The value of US market for packaged air conditioning solutions rose by more than 14% in 2018 to reach $20.4bn, this is confirmed by BSRIA’s newly published market study “Room, packaged, unitary and furnaces air conditioning study”

BSRIA estimates that 2019 will see further growth of just under 4% in terms of volume but over 8% in terms of value, to exceed $22bn this year. VRF will continue to see strong growth and although small compared to the overall AC sales it continues to be the 4th largest VRF market in the world, albeit still from a low base, while mini-splits will again grow in double digits. In contrast, PTAC is forecast to decline in volume but is still set to reach $379m by 2023.

US-style ducted splits still dominate, but growth is modest at around 3%, whilst the mini-splits market remains small at less than 10% of the US ducted splits market in terms of volume, but still expected to see double-digit growth.

The rooftop market is relatively mature and is expected to see modest volume growth with a CAGR to 2023 of less than 3%. Nevertheless, the US still accounts for 90% of rooftops sold in the world.

The ongoing trade disputes, notably with China are raising the spectre of higher tariffs which could increase prices of imported units. However, demand for more sophisticated products, including smart controls and IoT functionality could also increase purchase prices.

The relatively long payback period for more energy-efficient AC systems is a disincentive for consumers, for whom “smarter” features such as connected access and voice control can be more appealing. However, the commercial AC market appears to be more responsive to energy savings.

Connected features including remote control and monitoring are increasingly valued. For commercial AC solutions, these can provide improved resilience and a reduction in service and maintenance costs. However, this tends to apply most to more expensive and business-critical AC systems.

Future growth will depend very much on the health of the US economy and also on the political agenda regarding energy policy and also trade and tariffs, which emerges from the 2020 elections.

BSRIA research indicates that the value of US market for central plant air conditioning market rose by around 6% in 2018 to reach $3.2bn. This is confirmed by BSRIA’s newly published market study “Central Plant Air Conditioning Study.”

Driven by the longest expansionary economic cycle in the country’s history, robust construction growth and an acceleration in product replacement, the air conditioning market experienced growth in all its segments and applications (residential, commercial and industrial).

Over the past five years, product replacement is being fuelled by higher efficiency, green products and technology convergence. However, currently, the majority of the demand is coming from replacement rather than new build project

As expected for a mature market, growth generally did not exceed 5% in any of the product categories, but prices were under inflationary pressure resulting from the effects of the trade war between USA and China. Consequently, AC prices are expected to continue to rise over the next few years, also driven by a shift towards more energy-efficient and sophisticated systems and the use of new refrigerants.

The smart revolution has made an impact on the commercial market, where connectivity and data analytics is primarily used to reduce service and maintenance costs. Embedded monitoring devices are becoming a mainstream feature in commercial equipment.

The Chiller market expanded very modestly in 2018. Sales were propelled by higher efficiency systems, the use of new refrigerants and add-ons from suppliers, such as remote monitoring based on subscriptions, as a tool to retain customers and to store useful data on patterns of equipment utilization.

Often, the efficiency of old systems is improved by retrofitting a variable speed drive rather than purchasing a new unit. In terms of volume, sales are expected to remain fairly flat. Under a scenario of sluggish equipment sales, service represents a good opportunity to increase profitability and to retain customers until the next sales cycle.

Air handling units (AHUs) will follow suit, moving towards increasing fan motor efficiency, more controls and features to improve indoor air quality.

With regard to the fan coil market, this will remain highly commoditised, although BSRIA expects to see some innovation in fan motor efficiency. This market was less affected by inflationary pressures due to the fact of a large base of local manufacturers. Energy efficiency through the use of EC fan motors and noise reduction are the main trends, together with improvements in design to allow for easier installations.

The BSRIA report on air conditioning analyses the main trends underlying the US market with a deep dive into the demand evolution by product, segment, capacity, application and key components. Special focus is on the emergence of ductless in residential and light commercial, energy efficiency regulation and market forces, refrigerants, a fast-changing competitive landscape and outlook for the market within the next five years.