This ebook from Build-Zone Insurance offers a comprehensive, step-by-step guide to a new home warranty

Build-Zone was established as a 10/12 Year Structural Warranty provider in 2005.

We are experienced in underwriting Warranties for all types of developments, from a single-unit Private Dwelling House to some of the largest Residential, MixedUse & Commercial towers in the Country.

We only use A-Rated Insurers, which gives you the comfort you are buying a product with the long-term, financial security you require.

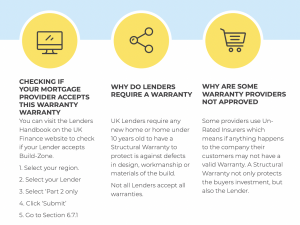

The Build-Zone New Home Warranty is approved by the majority of Lenders in the UK and recognised industry-wide.

Buying a property can be a stressful process but rest assured your new home has the best protection possible leaving you free to start unpacking all those boxes!

You are now a Build-Zone customer!

Your Home Builder or Developer has purchased a Build-Zone Structural Warranty which is backed by A-Rated Insurers to protect your new home.

What your developer should have provided you with:

1. Your Certificate and Policy Wording

2. Insurance Product Information Document (IPID)

3. The Build-Zone Consumer Code for Home Builders

What do you need to do next?

Don’t worry, as the new owner the Warranty is automatically transferred to you on completion of your purchase.

Why your choice of Insurer has never been more important?

Several Un-Rated Insurers have gone into liquidation in the last few years, leaving their

policyholders without cover.

As a result, many homeowners have been left without a valid Warranty and, in turn, breach

their mortgage terms. Build-Zone only uses financially secure A-Rated Insurers, giving you that extra security that your property has the best protection.

The defects period

If your certificate shows Section 4.1 is operative, during this period of time it is the developer’s responsibility to deal with any defects for the period shown. You should contact the developer directly if you have any problems.

The structural insurance period

For the remaining period of the New Home Warranty (or for the full policy period for other policies), all claims should be directed to Build-Zone using the claims procedure outlined in your policy. Your claim will be processed promptly to ensure a resolution as early as possible. Please see your certificate and Policy Wording for full details of the cover provided. Please contact Build-Zone if you need copies of these documents.

Build-Zone offers a range of Structural Warranty options

Generally, each Warranty is effective for 10 or 12 Years from the Date of Practical Completion. Please be aware that general snagging issues are not covered under the Warranty. Please see your Policy Wording for full details of your cover.

What is covered under a New Home Warranty

Your policy covers the property described in the Certificate of Insurance, which includes:

- the Structure (which is deemed to be part of any new, conversion, refurbishment,

renovation or extension Work to the Housing Unit); - all non-load bearing elements and fixtures and fittings for which the Insured is

responsible; - any Common Parts retaining or boundary walls forming part of or providing support

to the Structure; - any path or roadway providing access for the disabled;

- the below ground drainage system within the perimeter of such property for which

the Insured is responsible; - any integral or attached conservatory or garage to the main Structure which was

designed and included as part of the original plans and built at the same time as the

main Structure; - any detached garage(s), outbuildings and conservatories which was/were designed

and included as part of the original plans, built at the same time as the main

Structure, and noted on the Certificate of Insurance.

Garages and outbuildings may not be covered under your Warranty, please read your

Policy documents carefully to understand any Exclusions that may apply.

The following elements form part of the structure of the Housing Unit:

- foundations;

- load-bearing parts of floors, staircases and associated guard rails, walls and roofs,

together with load-bearing retaining walls necessary for providing support to the

structure; - roof covering;

- any external finishing surface (including rendering) necessary for the water-tightness

of the Waterproof Envelope; - floor decking and screeds, only where these fail to support normal loads;

- wet applied plaster;

- glazed panels to external windows and doors.

Period of insurance

10 or 12 Years from the Date of Practical Completion as specified in the Certificate of

Insurance.

Defects Insurance Period (Section 4.1)

The first one or two years from the Date of Practical Completion as specified in the

Certificate of Insurance.

Structural Insurance Period (Section 4.2)

The balance of the 10 or 12 year term following the expiry of the Defects Insurance Period.

If, during the Defects Insurance Period, the Insured notifies the Developer of any Defect,

the Developer is required to;

i) Effect a repair, replacement or rectification of such Defect as soon as practicably

possible;

ii) Reimburse the Insured for all costs including lifting and refitting carpets, storage and

alternative accommodation should the nature of any repair, replacement or rectification

be such that the Insured and/or the occupants have to vacate the Housing Unit(s) whilst

such repair, replacement or rectification Work is carried out.

Once notified of Defects during the Defects Insurance Period the Developer remains

liable in respect of those Defects that have already been notified for the full term of the

Policy, unless specifically agreed in writing by the Insurer(s).

The Insurer(s) will cover the Insured, during the Defects Insurance Period, against the

cost of repairing, replacing or rectifying any Defect in the Housing Unit(s) for which the

Developer is responsible and which is approved and notified to the Developer during

the Defects Insurance Period and which is notified to the Insurer within 6 months of the

expiry of the Defects Insurance Period.

The Insurer(s) will not be liable unless:

i) the Developer has refused to respond to the Insured’s Defect notification and/or;

the Developer has withheld consent to resolve the dispute by using the Mediation service

offered by the Administrator and/or;

the Developer has accepted the Mediation decision after using the Mediation service but

has failed to carry out the Works or repairs stated in the Mediator’s report within the time

frame stipulated;

and/or

ii) the Developer has not effected the repairs or Works determined by a binding legal process;

and/or

iii) the Developer has failed to effect such repair, replacement or rectification Work due to its insolvency.

In the event of a claim under this section, the Insurer(s) has/have the option of either paying the cost of the repair, replacement or rectification Works or arranging to have the repair, replacement or rectification Works carried out.

Special Conditions applicable to Section 4.1

Should the Insured receive any payment either in part or whole from the Developer in respect of a Defect that was subject to a claim settlement by the Insurer(s) then the Insured shall reimburse the Insurer(s) in full for the amount of such payment.

Exclusions applicable to Section 4.1

The Insurer(s) will not be liable to the Insured for any:

i) Dampness, condensation or shrinkage not caused by a Defect;

ii) Defect to the central heating system(s) and associated pipework, fitted appliances or

plumbing Works;

iii) Items that have been subsequently altered or added on behalf of the Insured at their request, written or otherwise;

iv) Chips, scratches, brush marks, and other associated minor blemishes to fittings and/or

decoration;

v) Contractual disputes between the Developer and the Insured or issues regarding

specification of items;

vi) Drawing performance of chimneys and flues;

vii) Adjustment of doors following the fitting of carpets and/or floor coverings and/or flooring;

viii) External landscaping or garden features and decks unless they form an intrinsic part of the Structure;

ix) Deterioration caused by neglect or failure to carry out normal or specific maintenance.

Code of Conduct for Home Builders

The Build-Zone Code of Conduct for Home Builders has been set up to ensure that the

interests of home buyers are protected before, during and after the purchase of a new

home. The code applies to all developments benefiting from a Build-Zone New Home

Warranty and requires the home builder to:

Claims process

If you do have a problem with your home, how you make a home Warranty claim will depend on the section of your warranty that applies.

You will need to check your Certificate of Insurance and Policy Wording, for details of the cover provided. Here is a brief overview of what is and isn’t covered in the majority of cases:

If you are unsure, please get in touch with us. Our claims team will guide you through the process so that we can help you as quickly as possible. You can contact our team directly below or email us at claims@build-zone.com.

Complaints procedure

It is always our intention to provide you with the highest quality service. However, we appreciate that occasionally things can go wrong.

When they do, four things matter most:

- That you know who to complain to;

- That you know how your complaint will be dealt with;

- That you feel confident that we will take your complaint seriously; and

- That where appropriate, we will put things right quickly.

Who to complain to:

Build-Zone is a trading name of Sennocke International Insurance Services Limited. Please

address your complaint and any subsequent queries you may have in connection with the complaint to the Managing Director.

Complaints contact details:

The Managing Director, Sennocke International Insurance Services Limited, 6 Pembroke

Road, Sevenoaks, Kent, TN13 1XR

Telephone: 01732 742102

E-mail: complaints@sennocke.co.uk

How your complaint will be dealt with:

- You will receive a prompt acknowledgement of your complaint telling you who will be

dealing with this. At this stage, we may need to ask you for further information. - Your complaint will be investigated promptly. If there is a delay in providing you with our

response, we will advise you of this and indicate when we will be in further contact. If we are unable to give you our decision within 8 weeks (2 weeks if your policy is insured at Lloyd’s), we will write to you again to tell you the reasons for the delay and when we expect to be able to provide this to you. - Our investigation of your complaint will take the form of gathering information from the

relevant people and reviewing documentation which we hold, and will be carried out by

a person who was not directly involved in the matter giving rise to your complaint. Your

complaint will be investigated thoroughly and fairly. - In assessing your complaint, we will consider this in light of similarities with other

complaints we may have received, and relevant guidance published by the FCA, other

relevant regulators, and the Financial Ombudsman Service or former schemes. - On completion of our investigation into your complaint, we will write to you and provide

you with a clear explanation of our findings and offering a fair and appropriate settlement, or taking appropriate action, if your complaint is upheld. - Where we have reasonable grounds to be satisfied that another respondent may be solely or jointly responsible for the matter alleged in a complaint, we will promptly forward the complaint, or the relevant part of it, in writing to that other respondent. We will inform you why the complaint has been forwarded, and of the other respondent’s contact details.

If we are unable to provide you with a decision within eight weeks and you are not satisfied

with the reasons for the delay, or you are unhappy with the final outcome of our investigation, you may be entitled to refer your complaint to the Financial Ombudsman Service (FOS), which is an independent resolution scheme. If this is the case, we will confirm this in our letter to you. We will give you the full name, address, and telephone number of the Financial Ombudsman Service and a leaflet entitled “Your complaint and the ombudsman”.

The website address for the Financial Ombudsman Service is:

www.financial-ombudsman.org.uk