RICS has released RICS guidance note: Sustainability and ESG in commercial property valuation and strategic advice, 3rd edition in follow up to 2013’s version 2. Maryanne Bowring, Ringley, explores the implications for property managers of this evolution of guidance, and what this means in practice

Clarity and relationship with the wider RICS guidance suite

The guidance improves on previous versions by making clearer its position in the wider universe of RICS guidance. There are cross-references to instances in the aforementioned documents that require or recommend valuers to adopt certain practices and many of those now refer to the need to have regard to ESG or sustainability factors. Valuers are expected to follow the market rather than lead it, and to place reliance on empirical evidence in support of valuations and strategic advice, which remains core to the guidance.

Reporting and disclosure requirements

This means that ESG indicators will continue to lag the market rather than lead the market. The exception is where regulation makes mandatory improvements to the physical building or mandates disclosure of information that previously would not have been in the public domain. For managers, information disclosure upstream by property owners and investors, such as for GRESB returns, will tend to place additional obligations on managers, either within the scope of existing framework agreements or at the onset of new obligations. During void periods, such obligations may prove challenging unless splits in energy purchasing, control and use are such that data can be easily metered or measured.

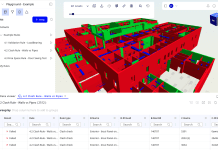

During mobilisation, too, there is likely to be a renewed emphasis on setting up the building for success, with appropriate metering of consumption and the use of sensor tech and smart devices to make performance visible to users, in an effort to nudge efficient behaviour. There will also be a greater emphasis on aftercare, with an accompanying need to ensure good feedback loops and learning from building data to ensure buildings perform well.

Client preferences and valuation methodologies

A property manager will typically be responsible for maintaining the value and worth of a building for the functions they perform. How ESG factors into the concerns of a manager are likely to vary depending on the priorities of the client, as this may affect the type of valuation(s) undertaken, how at risk of obsolescence the property is, and how close to a lease or transaction event it is.

A property owner may, for example, specify the use of discounted cash flow (DCF) which can absorb ESG factors into calculations (e.g. if considering energy efficiency upgrades). In such cases, the manager may hold responsibilities to obtain data from owner and occupier areas in order to understand what improvements might matter, and possibly to collect operational information to understand if improvements are having a positive effect. The client may also require active management to be undertaken to manage down inefficiencies and to work with facilities managers to try to make the building perform as close to design specifications as possible.

Risks around lease events

Perhaps one of the clearest implications for managers lies around the risks associated with lease events. The press has highlighted the risk of obsolescence and depreciation associated with market forces and regulatory standards. Arguably, the latter is a stronger concern at this point, in England and Wales, as regulations that make it unlawful to continue to let a building that fails to meet a minimum EPC rating of E are about to be ratcheted up to C by 2028 and B by 2030. The clear risk is that a lease event presents a requirement for building upgrades. For managers of buildings belonging to long-term investors, other concerns are likely to manifest in the coming years; the shift away from fossil fuels is likely to mean changes for older residential buildings as gas boilers are replaced with heat pumps and electric vehicle charging is introduced.

An evolving landscape

For both managers and valuers, the guidance represents a framework for action. ESG responsibilities are likely to broaden and deepen over time as the market moves and regulations are ratcheted up. In the intervening period since the last guidance was published, the concerns relating to ESG have broadened and deepened, and the world as a whole has agreed to climate targets for 2030 and 2050. The letter of the guidance lays foundations for the treatment of ESG concerns in general, but it is worthwhile remembering that ESG is a process rather than an event; what is important today is likely to be followed by other factors in the future. This places an emphasis on managers to ensure that they maintain CPD and a certain curiosity as well as a problem-solving mindset, given the challenges we face, both known and unknown. This means that the value of soft and interpersonal skills has never been more important in managerial positions.

![[Video] Fireco: 80 new fire doors required for residential flats in London](https://www.pbctoday.co.uk/news/wp-content/uploads/2025/04/2024-06-01-Lords-view-one_1200x750_004-218x150.webp)