The introduction of new technologies, the advancement of equipment, changing skill requirements, increasing demand for more innovative projects, and shorter time frames mean that things are changing for the construction industry and will continue to do so for the foreseeable future

This report by Asite provides a snapshot of the future trends shaping the construction industry, the opportunities and issues it faces in 2020 and exemplifies the virtues of a regionally engaged and globally responsive approach.

The construction sector is one of the largest in the world economy. Due to its sheer magnitude and different layers, transformation takes time. So, when a threat or an opportunity appears, how does the industry come together to approach the situation, share its successes and build an ecosystem in which to thrive?

This report examines the first quarter of the year and explores the shape of the 2020 construction market, providing an insight into expected trends set to make the biggest impact. From the rise in the adoption of smart building technologies in the USA and the growth of modular construction in India to taking a deep dive into some of the world’s most innovative and bold projects, this snapshot report delves into some of the most exciting developments of this year.

Covid-19 is one of the biggest threats this world has faced. This report sheds some initial light on its impact on the entire construction sphere and its effect on the rate of uptake on some of the outlined trends.

However, the true extent of the crisis in our industry remains unknown. Nevertheless, there is a high level of confidence that innovation and technology will not take a back seat, and together we can push forward and build better.

Safeguard our society for the future

Speaking about the report, Asite CEO Nathan Doughty said: “2020 has not been the year we imagined and planned for. The construction industry is facing a turbulent few months as we all try to deal with the current pandemic.

“Now more than ever, I believe we need to come together to prepare and safeguard our society for the future. Construction and infrastructure are vital to our ability to collectively safeguard the health of our fellow citizens, and to educate, feed and house us all. We must keep building, and inevitably we will. The question is how do we build resilience into the industry and into the fabric of the built environment itself?

“Digital engineering and remote-working technologies present opportunities for many organisations to continue with business in the face of change. Sharing innovation from colleagues around the world will help us all to advance collaboratively.

“I’ve seen first-hand how the construction industry can overcome adversity and help rebuild following times of hardship. Construction was fundamental to crisis response and in the rebuilding process in my hometown of Houston after Hurricane Harvey three years ago.

“Today, the industry has quickly geared up to deliver hospital beds for health services across the world and re-geared manufacturing for PPE and health equipment. We can build on lessons learned in difficult times. Connecting people around the world will help us learn from one another and innovate.”

Region – United Kingdom

We all have a responsibility to focus on the wellbeing of our people and our society whilst looking to the future to meet evolving opportunities and challenges. This is absolutely critical as we enter the second quarter of 2020.

The UK’s Budget for 2020 indicates a huge boost for infrastructure with planned investment in roads, railways, affordable housing, and broadband over the next five years.

We are witnessing this same commitment to developing infrastructure and facilities from governments in India and the Middle East facilitated by technological advancements.

The drive to develop smart cities supported by BIM, modular construction, and digital twins looks set to characterise the industry globally over the next few years, and the UK appears to be preparing to lead the way.

New focus on sustainable supply chains

In response to increased scrutiny of the construction industry and its environmental impact, companies are rethinking their approach to procurement.

Pierre-Francois Thaler, co-CEO of EcoVadis, argues that procurement professionals are in an ideal position to address sustainability issues as supply chain is the biggest lever for change.

As noted by Construction Online, buyers are more likely to seek out environmentally conscious suppliers, and suppliers will need to be able to demonstrate their green credentials.

Post-Brexit decline before stabilising

65% of the construction industry say they are either concerned or highly concerned about the outlook for the industry post-Brexit.

There is concern this may lead to a possible dip in construction activity in 2020; this requires the industry to build resilience and prepare itself for this suggested possible decline.

Advancements in BIM by 2025

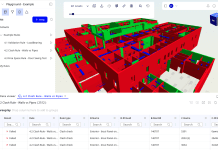

The UK Government and industry expected to make advancements in BIM by 2025. This progression is key to the ‘Digital Built Britain’ strategy which will improve transparent data sharing capabilities.

Increased focus will also be placed on Digital Twins in an effort to keep up with rapidly evolving digital construction technology. We will see these developments benefit projects and government supply chains greatly over the coming years.

Investment in budget 2020 for decade of growth

Chancellor of the exchequer, Rishi Sunak, announced £640bn of gross capital investment into the UK’s roads, railways, schools, hospitals, and power networks by the end of the Parliamentary term in a cash injection that will be triple the average over the last 40 years in real terms.

Sunak argues that “investing historic amounts in British innovation and world-class infrastructure, [we] will rebalance opportunities and lay the foundations for a decade of growth for everybody.”

Other regions mentioned in the report include: Europe, Asia-Pacific, North America, the Middle East and India. You can view the analysis in full here.

Report conclusions

Industry growth was projected across the board for 2020 and, with this optimistic outlook, we’ve seen significant government investment and anticipated the return on this investment in the form of healthy industry growth. However, the global spread of Covid-19 and the developing economic fallout seem set to undermine these projections.

With climate change a huge topic last year, much of the conversation in early Q1 was focused on sustainable building, procurement, and energy. As public engagement with the issue deepened and attitudes shifted, we saw the UK, Europe, and India outline big commitments at a policy-level. However, the question now is whether these commitments will be upheld as public and corporate priorities shift amidst the pandemic.

Digital engineering and a drive to build better were perceptible across all of our regions of interest. While the UK projected a progression to BIM Level 3, countries in North America and the Middle East prepared themselves to dominate the smart city market. Unfortunately, with workforce shortages and closing sites, the projected timelines for these ambitious projects will likely be affected. That said, this doesn’t mean that technology and innovation will take a back seat as there is a good chance that the answer to mitigating the impact of the virus will lie here.

Similarly, urbanisation seemed positioned to continue as an important topic of conversation in Q2, particularly in India and the wider Asia-Pacific region. As noted by the World Economic Forum, “few trends have matched the economic, environmental, societal impact of rapid urbanisation.” In light of the coronavirus outbreak, we will likely see conversations surrounding the relationship between urban development and new or re-emerging infectious diseases dominate discourse next quarter.

Notably, the UAE has so far remained resolute in its continuation of large-scale development projects. This apparent readiness and relative resilience may be due, in part, to the fact that this is the second coronavirus outbreak to affect the Middle East (MERS in 2012). The response of the industry in this region, and its lessons learned, could provide a starting point for establishing a flexible and pragmatic operating model in the coming months.

McKinsey, for example, is calling for the establishment of integrated ‘nerve centers.’ These are “an efficient means of coordinating an organisation’s active response to a major crisis endowed with enterprise-wide authority, which would enable leaders and experts to test approaches quickly, preserve and deepen the most effective solutions, and move on ahead of the changing environment.”

The construction sector already has a culture of modelling and analysing data, and these skills are transferable. We believe that the focus from now and through Q2 should be designing strategic models that are, as asserted by McKinsey, “based on adequate stress testing of contextualised hypotheses and scenarios.” These should prioritise safeguarding operational viability, building resilience and, most importantly, protecting workers.

If there is anything to be taken away from this report, it is that the interdependence of regional construction industries has never been more apparent. Materials, equipment, contractors, labor, supply chains, and technology are sourced from around the world. So, while trends and developments may vary between nations and regions, the integration of markets and economies along with the unprecedented reach and flow of information means that any strategy should be both regionally engaged and globally responsive – now is not the time to operate in silos.

Disclaimer

This report is based on market perceptions and research carried out by Asite. This document is intended for informative purposes only and should not be construed or otherwise relied upon as investment or financial advice (whether regulated by any financial regulatory body or otherwise) or information upon which key commercial or corporate decisions should be taken.

You can access the full report here.