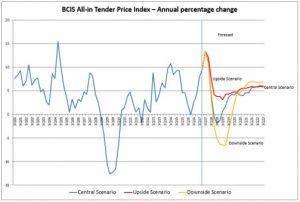

Tender prices are expected to fall in the year to 3rd quarter 2018, according to the latest BCIS five-year forecast

Tender prices have risen in 2017, but with output remaining unchanged in 2018, and with uncertainty about the effect of Brexit negotiations in the private commerical sector, tender prices are expected to fall in the year to 3rd quarter 2018, according to the BCIS tender price forecast.

The current forecasts are based on the UK’s exit from the EU at the end of the two-year period following the signing of Article 50.

Based on the most recent data from the Office for National Statistics for 2017, new work output for 2017 is now expected to rise by 3.7%. In 2018, it is anticipated that new work output will remain unchanged, resulting from a fall in private commercial output, which continues in 2019, leading to a growth of 1.1%.

Stronger growth in new work output in 2020, 2021 and 2022 of 4.2%, 5.7%, and 4.7% is predicted to be driven by infrastructure output and a return to growth in the private commercial sector.

BCIS will continue to produce forecasts based on three scenarios which reflect the different political outcomes from Brexit.

The three scenarios are as follows:

- An ‘upside’ scenario:

- The UK remains a member of the EU but with no voting rights from cessation of the two-year period following the signing of Article 50.

- A transitional period of two years follows, with continued payments to the EU (which will be deducted from the final ‘divorce bill’). Negotiations run a lot smoother than with the ‘central’ scenario, providing investors with greater clarity at an earlier stage.

- Trade agreements with the EU will be the same as prior to the EU Referendum, and those with the rest of the world will boost the UK economy.

- Sterling exchange rates are expected to remain depressed until the end of the transitional period, then return to pre-EU Referendum levels thereafter, with a consequential reduction in imported materials prices.

- Free movement of labour continues to the end of the transitional period, with an exemption on movement of operatives in the construction industry thereafter.

- It remains desirable for EU workers to work in the UK, and that demand for construction operatives in the EU remains unchanged.

- The economy picks up during the transitional period as confidence returns.

- A ‘downside’ scenario:

- Any trade agreements with the EU are a lot less favourable than prior to the EU Referendum, and there are restrictions on the movement of labour.

- Sterling exchange rates worsen, which adversely affects the price of imported materials and the desire of EU construction workers to work in the UK.

- The UK starts paying a ‘divorce bill’ from 1st quarter 2019.

- The economy goes into recession during the transitional period and only recovers at the end of the forecast period.

- A ‘central’ scenario:

- The UK remains a member of the EU but with no voting rights from cessation of the two-year period following the signing of Article 50, i.e. from 1st quarter 2019.

- A transitional period of two years follows, with continued payments to the EU (which will be deducted from the final ‘divorce bill’).

- any trade agreements with the EU are less favourable than prior to the EU Referendum.

- Sterling exchange rates are expected to remain depressed until the end of the transitional period, then gradually return to pre-EU Referendum levels thereafter.

- Free movement of labour continues to the end of the transitional period, with restrictions in movement after that.

- It remains desirable for EU workers to work in the UK, and that demand for construction operatives in the EU remains unchanged.

- GDP recovers slowly towards the end of the period as confidence returns.

BCIS has assumed that ‘No deal’ is very unlikely to occur as one of the EU exit options.