The government has set itself the demanding challenge of building 300,000 new homes by 2022; however, a number of long-standing issues within the construction sector are still acting as roadblocks to tangible progress. In order to deliver on housing supply, through a more efficient, productive and aspirational construction sector, the industry requires wholesale innovation and collaboration

Kim Vernau, CEO at BLP Insurance, highlights the key points raised at an interactive discussion organised for industry peers on the need for collaboration and innovation in the construction industry, with a particular emphasis placed on offsite construction. Guest speaker, Alex Notay, Director of Product and Service Innovation at Places for People, one of the UK’s largest development, regeneration and management companies, provided valuable insight from the perspective of creating effective community outcomes through successful collaboration. This paper summarises her speech on this subject.

Why collaborate?

Collaboration is defined as ‘the action of working with someone to produce something’ or, alternatively, ‘traitorous cooperation with an enemy’. Too often within the construction industry the latter meaning is borne out. Contrasted with other sectors such as aerospace or automotive engineering, the dissonance between the closely related construction industry and the real estate market is stark. Combined with other issues, such as a lingering image problem, ageing workforce and the uncertainty of Brexit, it is clear that the industry is in need of galvanisation.

The first area requiring much-needed attention is the outdated contracting model, which needs to adapt to become broader, holistic and fit-for-purpose. One route to improving this would be through shared investment in industrywide innovation as modelled by so many other sectors i.e. aviation.

Private and public sector cooperation

There is too often a perception that the public sector is slow, bureaucratic and doesn’t understand commercial realities. On the other hand, the private sector is often stereotyped as rapacious, profit focussed and as having no regard for the needs of communities. Whilst flaws exist on both sides, ultimately a dynamic shift is needed in the way public and private sectors cooperate.

In recent years, local authorities have seen their budgets decimated. This has led to the migration of skills and knowledge to the private sector and a greater need for public sector bodies, including government agencies and housing associations, to partner with private sector providers. This should act as positive encouragement for local authorities to form lasting, genuine partnerships that can benefit both parties.

The role of SMEs

In most European countries, approximately 33% of housing output is delivered through SMEs, whereas in the UK 98% of housing output is from the top ten volume housebuilders. Putting structures in place to provide genuine sub-structural support for SME builders and developers could be one of the biggest game changers in the industry. SME developers have the capacity to build at quality, to cost, and in a timely manner. By enabling this through the local authority planning process and access to finance could provide a tangible boost in terms of hitting housing targets. While the government already recognises the value SMEs can bring to its housing ambitions, progress in this area will require serious collaboration and dialogue which has traditionally been absent.

A scalable problem

At present, only 15% of UK construction capacity goes towards UK housing and a shift in focus from other areas of the industry is needed. The industry is simply not exploiting its potential to deliver housing. There has been a noticeable influx of global investment into the sector through an increased institutional appetite for ‘beds’ and rental asset classes, from student, to PRS, Build to Rent and retirement. In addition, modular technology brings with it a real opportunity to build smart, efficient and cost-effective homes at scale.

Build to Rent (BTR) in particular, offers the potential to deliver homes on a mass scale, enabling communities to be planned and run effectively. BTR can offer greater choice to a lifestyle renter but also to those people who, may not be able to get onto housing ownership ladder either as soon as they’d like or potentially ever. Genuinely high-quality experiences are sadly not the norm in a poorly-regulated private rented sector, particularly for the ‘squeezed middle’. BTR communities, constructed to a mass scale using offsite and modular construction, is not a silver bullet, and will only ever be a component part of the wider PRS, but could help alleviate a significant proportion of the burden of the current housing shortage.

Data sharing

The ongoing internationalisation of the industry, as a result of foreign investment, could also lead to a positive change in behaviour in other areas such as data sharing. In the UK, data around occupancy rates in the BTR space is held very secretively whereas this data is freely available and openly shared in the US market. US companies still compete, but they are confident in their product and offering, often providing competitors with access to their latest construction projects. The collective sharing of ideas and data across companies, sectors and the industry as a whole shouldn’t be seen as some pipedream but rather a necessary evolution that can transform the way the sector is perceived and thereby revolutionising the way we deliver homes.

The capital conundrum

The government needs to overcome an historic obsession with small and isolated demand-side interventions, including populist housing policies such as the Help to Buy scheme, and instead focus more on bigger picture supply-side issues. The 2017 White Paper was an encouraging step towards this in acknowledging for the first time in decades, the importance of tenures other than ownership. In doing so, it can generate more housing stock of different tenure types in multiple areas, which meets the needs of today’s society. The so-called “active adult”, between the ages of 55 and 85 is a group which didn’t exist 20 years ago, who want to downsize but who don’t want to live in a traditional retirement community. Currently there is not the appropriate housing stock to suit their needs.

Some developers in the market have been very bold in revaluating their delivery model, understanding that the type of stock being built 10 years ago isn’t sufficient today. More creative problem solving is needed to provide workable supply-side solutions necessary to alleviate the housing shortage.

Onside with offsite

In order to achieve its target of building an extra 150,000 homes a year, the government must embrace and promote offsite or modular construction. However, those within the industry also need to play their part, collaborating to unblock the barriers that currently stand in the way of its widespread adoption. Initiating a common effort around standardisation of components is vital. Dependency on particular providers and incompatibility of components is impeding uptake of a range of modern methods of construction as this creates a much higher risk profile for investors.

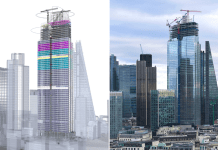

Another barrier is the perception of offsite builds, which continues to conjure up images of crude 1970’s “prefabs”. The industry needs to be better at communicating what offsite actually is (both within and outside the construction sector), emphasising the precision of the engineered manufacturing process or DfMA (Design for Manufacture and Assembly), innovative technology, practicality and tangible savings in waste, cost and time.

A viable comparison is that of autonomous vehicles. To maximise the reach of autonomous vehicles, manufacturers will have to overcome an ingrained aversion to not being in control and trusting in something machine built and operated. The same principle is true in construction; the initial apprehension of offsite construction has to be counteracted to the point where people are comfortable living in a 15 storey apartment that was built digitally or constructed offsite.

For offsite construction to truly revolutionise how we deliver homes may require a trailblazing innovator to disrupt the sector. The residential property market tends to lag behind the wider real estate industry, for example, WeWork has already transformed the commercial office market and Airbnb has irrevocably changed the way people book short-term accommodation. There is room for pioneering companies within the residential space to dictate the pace of change for offsite construction.

Conclusion

There is no quick fix solution to the multiple issues facing the housing industry and wider construction sector, and initiatives around SME builders, local authority planning, providing suitable housing for the elderly and the implementation of offsite technology will all take time.

To exact meaningful change requires not only long-term commitment and investment from major industry stakeholders, such as the government and large developers, but also a collective will to shift the industry’s cultural mindset. By instilling a greater appetite and aptitude to collaborate across the sector, all participants can benefit from a more progressive, efficient, cost-effective and innovative construction industry.

A very thought provoking article. For innovation to truely break through we must also address our respective commercial skeletons. Reaching an amicable agreement around sharing of risk and reward in addition to suitable commercial incentives/motivations is key to unlocking the kind of efficiencies that the automotive industry has seen. If the client wishes to offload all risk associated with the innovation to the contractor whilst retaining all of the benefit the industry will not move forward. More work is needed to re-write the terms of engagement and make project insurance policies more affordable.