Construction output increased by 0.1% in the three-month on three-month all work series in August 2019, according to the lasted ONS figures

Construction output increased by 0.2% in the month-on-month all work series in August 2019; this was driven by a rise of 1.1% in repair and maintenance, offset somewhat by a fall in new work of 0.2%.

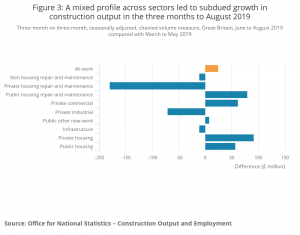

In new work, the increase in the three-month on three-month series in August 2019 was driven by private new housing, private commercial and public new housing, with rises of 1.0%, 0.9% and 3.6% respectively.

In repair and maintenance, the fall in the three-month on three-month series in August 2019 was largely because of the 3.5% decline in private housing repair and maintenance, with a smaller contribution from a 0.2% fall in non-housing repair and maintenance.

Construction output in August 2019

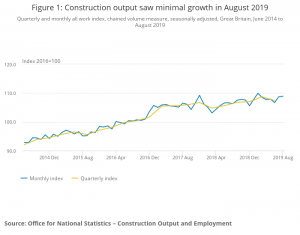

Since the record high of £13,869m recorded in the monthly all work series in February 2019, the industry has experienced a mixed profile of monthly growth, with falls in March, April and June largely offset by increases in May, July and August. The level of construction output in August 2019 is now £123m below this record high.

Figure 1 shows the monthly and quarterly indexed chained volume measure, seasonally adjusted series. The quarterly series provides a smoother and more comprehensive view of trends within the construction industry than the more volatile monthly series.

Contributions to growth

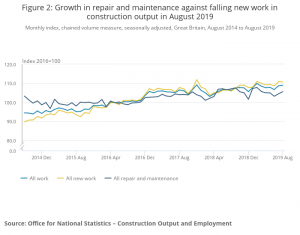

Construction output can be broken down by different types of work; these are categorised into all new work, and repair and maintenance, as shown in Figure 2. It is worth noting that all new work accounts for approximately two-thirds of all work, while repair and maintenance accounts for approximately one-third.

Figure 2: Growth in repair and maintenance against falling new work in construction output in August 2019

There was a month-on-month decrease in new work of 0.2% in August 2019, while repair and maintenance saw growth of 1.1%. For new work, the sector experienced a mixed profile of growth, with private commercial new work (1.0%), public new housing (3.3%) and private industrial (3.8%) experiencing increases whereas private new housing (0.9%), infrastructure (1.3%) and public other new work (3.1%) saw falls.

In repair and maintenance, the growth of 1.1% comprised growth across all the components within the sector. Non-housing, and private housing repair and maintenance saw the largest growth, increasing by 1.4% and 1.0% respectively.

Figure 3 shows the difference in the three-month on three-month levels from the different construction sectors, taken from our seasonally adjusted, chained volume measure series. Construction output increased by £25m in the three months to August 2019, compared with the previous three months.

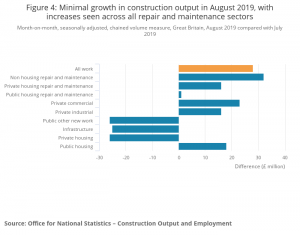

Figure 4 shows the difference in month-on-month levels from the different construction sectors, taken from our seasonally adjusted, chained volume measure series. Compared with July 2019, construction output grew by £28m in August 2019.

For new work, output decreased by £21m in August 2019. This minimal decline comprised relatively minor increases or decreases across all types of work. Private commercial new work, public new housing and private industrial new work saw relatively small increases of £23m, £18m and £16m respectively. While private new housing, public other new work and infrastructure saw relatively small decreases of £26m, £26m and £25m respectively.

In contrast to new work, repair and maintenance saw an increase of £49m in August 2019. All types of work within repair and maintenance saw an increase, with the main driver being non-housing repair and maintenance, which grew by £32m in August.

Kevin Reid, chief executive of the Cruden Group, comments on the ONS Output in the Construction Industry: “The overall impact of Brexit, in whatever guise, remains to be seen. However, fundamental change may be slower than perhaps anticipated – other than price inflation and reduced availability of materials sourced from the EU, which the industry is currently experiencing.

“Despite these challenges, at Cruden we have secured a strong pipeline of activity up to March 2021 and a growing order book beyond that.

“Overall, we remain cautiously optimistic about the year ahead, despite the significant economic uncertainties that lie ahead.”