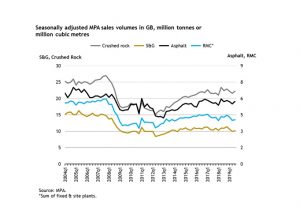

Following a weak first half of 2019, construction market demand for mineral products, including aggregates, asphalt, ready-mixed concrete (RMC) and mortar, improved in 2019 Q3 compared to the previous quarter

Growth in mortar sales was the strongest, up 5.2% compared to 2019 Q2, followed by asphalt (4.1%), aggregates (2.7%) and RMC (1.4%).

However, this improvement has not been sufficient enough to lift the market performance for 2019. In the first 9 months of the year, markets for asphalt and mortar remained broadly flat compared to the same period in 2018, while sales of aggregates and RMC declined.

The Office for National Statistics (ONS) estimates that construction output increased by 2.6% over Jan-Aug 2019 compared to the same period in 2018, with growth driven by housebuilding and new infrastructure work.

Work on commercial sites continues to decline. Aggregates and RMC are used in any type of construction work, usually in the early stages of a construction project timeline. Therefore suggesting that recorded construction output reflects continuing activity on existing sites rather than new sites.

Highways England knock-on effect

Despite plentiful work planned on Highway England’s roads programme this year, asphalt sales volumes saw a marginal decline by 0.6% over Jan-Sept 2019 compared to the same period in 2018.

The Mineral Products Association (MPA) members continue to report significant delays to the Road Investment Strategy (RIS 1) delivery.

Highways England has indicated that 37 of the 112 projects set to be carried out over 2015-20 have now either been pushed back to 2020-25, or put on hold altogether for review.

Of the 75 remaining projects to be delivered by the end of FY2019/20, 30 are planned to start during the current financial year. Given past delivery records, the industry has little confidence in Highways England’s capability to ensure these projects are delivered as planned.

Similarly, the RMC market remains decisively weak and is heading for a third consecutive year of decline in 2019.

The demand for mineral products is closely tied to falling investment in commercial buildings, which has been impacted by the ever-increasing domestic uncertainty surrounding Brexit. It also reflects slower housebuilding activity in the capital.

Mortar sales are an indicator of housebuilding activity. After a year of consecutive quarterly falls, mortar sales volumes resumed growth in 2019 Q3, up 5.2% compared to the previous quarter.

Yet again, the annual trend for 2019 remains weak: sales volumes increased by just 0.4% in the first 9 months of 2019 compared to the same period in 2018.

Forecasts for the market

Current construction forecasts suggest housebuilding will pick up again from 2020, given continued support from Government’s Help to Buy scheme. Weakness in the commercial sector is expected to remain until at least 2021, as investment is being hindered by Brexit negotiations.

If delivered as planned, major infrastructure projects in roads, rail and energy should boost demand for mineral products over the next few years, but concerns are rising over the delivery of these projects, notably in the rail and road subsectors.

The government-commissioned review into HS2 is likely to add further delays, whilst work on RIS1 looks unlikely to be delivered as planned.

Aurelie Delannoy, director of economic affairs at the MPA, said: “Government cannot overestimate the significance of the current infrastructure pipeline of work for both construction and its supply chain, and for the UK economy as a whole.

“At a time of great reckoning for the UK’s political and economic future, repairing local roads, building houses, schools, hospitals, and upgrading major rail and energy networks provide the means to lift both short-term and longer-term productivity and growth prospects. It is a great opportunity to put our own house in order.

“Regardless of any Brexit outcome, it is in the power of the UK government to ensure planned infrastructure investments are being delivered in a robust and timely manner.”