2019 will see a digital leap forward as many construction companies explore implementing integrated business software into projects for the very first time

Tighter margins, global skills shortages and new industry entrants are all ramping up the pressure on traditional construction businesses to deliver greater productivity and more integrated, cost-efficient projects, on time, every time.

Prediction #1

50% of all construction projects worldwide will include modular content by 2022, driven by the growing global skills shortage

In March 2018, a new factory opened outside Liverpool, England employing 150 people 24 hours a day. What does it manufacture? Homes—starting with a first order of 81 homes and 58 apartments, as part of a first-year target of 450 homes. And it’s just one among many. At IFS, in 2018 we had four times greater customer activity around modular construction than in any previous year.

From schools in Ireland to prisons and hospitals in the United States; from sustainable luxury apartments to vast workers’ dormitories, 2018 has seen modular construction go well beyond hype. In 2019 it will get even stronger, with housing shortages a key driver. The UN estimates that over 2 billion new homes will need to be built over the next two years. Modular manufacturing enables affordable houses to be built faster and at higher volume. Driven by a worldwide shortage in skills and housing, increased modular construction will impact the construction industry massively in 2019.

New entrants will make agility even more essential

For a start, we’re already seeing a wave of new entrants coming into the industry. Take that modular housing factory in Liverpool. Neither of the two founders came from the construction industry. One, Luke Barnes, was a design engineer, his partner a software engineer. Barnes told reporters: “I found there was a big gap in the market as there were no constructors that offered the quality, deliverability and competitive pricing I was searching for.”

2019 will see growing numbers of traditional construction companies begin opening modular factories to stay competitive. And more new players enter the industry—from manufacturing, supply chain and logistics, to local governments, banks and insurance companies. Many will be able to offer flexible finance and service packages too.

The pressure on incumbent building firms to adapt will be huge. They’ll need tighter control and more adaptability over every aspect of their projects. Proving they can, if necessary, partner up with larger networks of suppliers, offer services and maintenance on assets once built, include equipment hire, and yes, even offer or manufacture some modular units or components. It all adds up to an urgent need for better, more integrated digital management of complex, demanding projects. That need is driving my second industry prediction.

Prediction #2

In 2019 more construction companies than ever before will start trying out integrated business software — for the very first time

10% of traditional construction firms could go out of business over the next 5 years. Competition around delivery and productivity will be fierce. Many companies will find themselves balanced on a knife-edge of opportunity: On the one hand growing urban populations and housing shortages will mean more demand and higher order intake. On the other, shrinking profit margins and increased competition will mean unprecedented pressure on productivity and delivery.

As a result, 2019 will see more firms moving from being document-driven to data-driven. Many will take their first steps into digital and make their first investments in integrated business systems like Enterprise Resource Planning, or ERP. Two main drivers will turn integrated business systems like ERP from a nice-to-have into a need-to-have.

When less is more: Growing pressure on margins

With profit margins as tight as they are, many construction firms feel as if the more business they bring in—the less money they make. A recent Deloitte report found that construction companies’ profit margins are under pressure in several European submarkets, with Western Europe particularly vulnerable. In the UK, Belgium, the Netherlands and Ireland profit margins are so narrow they may not even be offset by higher order intake. 31% of the UK’s largest contractors reported a fall in margins in November 2017, with the country’s largest 10 contractors having a negative average margin of -0.5%.

New entrants: China, Korea… and Amazon?

Global competition is growing powerfully, impacting European construction companies hard. The Engineering News Record’s Top 100 Global Contractors In for 2017 found that European firms made up only 23% of the world’s Top 100 Global Contractors in 2017.

In 2010, 44% had been European. Compare that to Asia, which rose from 41% in 2010 to 51% in 2017, and the big picture is clear. Most analysts predict that China, India and the US will all be winners in the forecasted 8 trillion USD growth expected in construction by 2030—but not Europe.

Companies like China Communications Construction, Hyundai Engineering & Construction and Samsung C&T represent a serious threat to large European incumbents. Taken by revenue alone, even by 2017 the Top Four and seven out of the world’s Top Ten largest construction companies were all Chinese.

With many able to offer highly competitive and flexible financing packages. As we’ve seen, the rise in modular is bringing in new entrants from the manufacturing, supply chain and software engineering sectors. And given all this, who knows, could even digital giants like Amazon or Uber one day see construction as a sector ripe for disruption? If so, who’d put money on the industry in its present state surviving the challenge?

The bottom line is that many construction companies are highly exposed. In 2018, we saw huge ongoing efforts to drive efficiencies, increase productivity and establish repeatable delivery. In 2019, the pressure will be even more intense. The need for adaptability has never been more urgent. 2019 will be the year when many companies finally start considering systems like ERP not as isolated back-office finance functions—but essential, joined-up systems that provide urgent coherence, speed and efficiency throughout a project or business. 2019 could be the year when construction takes a giant leap forward, embracing digital adoption.

Prediction #3

Digital asset life cycle management, integrating both BIM and ERP, will emerge as a future need-to-have

The collapse of Carillion, one of the UK’s largest construction giants, sent shockwaves through the construction industry. The company built and maintained major assets such as schools, prisons, hospitals and power stations across the UK—before collapsing 1.7 billion euros in debt, overnight, in January 2018. While analysts have endlessly debated how and why, insiders point to many systemic faults.

Certainly, in a company that size, spread over that many projects, it seems fair to say that without a central, integrated business system it would be all too easy for senior management to get a full picture of the truth. For the truth to be hidden. And for projects to be kept separate and siloed, financially and operationally.

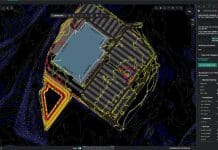

Central to ERP’s power for construction companies is its ability to connect and integrate all functions in a project—from finance to operations to design—enabling maximum adaptability. I’ve always argued that Building Information Modelling (BIM) will be a driver of digital asset life cycle management and integration. BIM is an integral part of moving from a document-driven to data-driven world. In 2019, I believe we’ll see the first construction companies take their first steps into discussing how to merge and build on the strengths of combining the two systems: BIM and ERP.

Many firms have now started to integrate BIM models into their business. But building BIM on its own without an integrated business system, is only a small part of the picture. As a business system, ERP takes all the functions of the business and provides it with one set of data, enabling it to flow through a project’s life cycle all the way from inception to disposal, and enabling any combination of service or asset management in between.

For manufacturers, integrating ERP as a whole business system, rather than a single financial tool, is old news. They’ve been successfully integrating CAD with ERP for years. However, for many companies in the construction industry, that journey remains to be made. But 2019 will see many taking their first, vital steps.

Kenny Ingram

Global Industry Director for Engineering, Construction & Infrastructure

Twitter: @IFSworld