The Nationwide November House Price Index has revealed that UK house prices fell at the swiftest rate since June 2020, with annual growth slowing to 4.4%

UK house prices fell at the fastest rate since June 2020 as the ramifications of the Truss administration’s September mini-budget continued to spook buyers.

According to the Nationwide house price index, the average home dropped by 1.4% to £263,788 in November.

The index reported a considerable UK house prices drop after a turbulent economic period

The house price growth index documented a slowdown in annual house price growth to 4.4%, from 7.2% in October, whilst prices fell by 1.4% month-on-month- the largest fall since June 2020.

New buyers face growing financial constraints on their ability to buy, from the lasting high inflation post-mini-budget creating high-interest rates on mortgages and rapidly rising household energy bills. These factors compromise a new buyer’s ability to save and may account for the cautionary market’s decline.

Affordability varies significantly between regions

Nationwide’s chief economist Robert Gardner observed that affordability was being stretched across the UK, though certain regions faced steeper conditions than others.

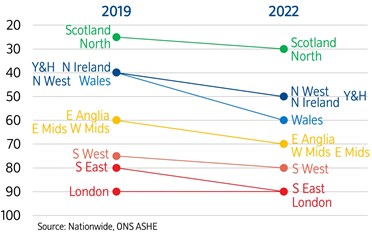

Where a higher income percentile indicates that a larger proportion of people are priced out of the market or need to borrow a greater income multiple to buy a home, a typical buyer in Scotland and the North of England sits in the 30th income percentile.

“Similarly, in East Anglia, East Midlands and West Midlands, the typical buyer has moved from the 60th percentile to the 70th percentile,” Gardner reported.

“However, the biggest deterioration in affordability since 2019 has been in Wales, with the typical buyer now located in the 60th income percentile, compared to the 40th percentile in 2019.

“Conditions remain most stretched in the capital; in 2019 the typical London buyer was already located above the 90th income percentile. The surrounding South East region has now joined it, with the typical buyer moving from the 80th income percentile in 2019.”

Industry analysis of the UK houses price drop

Joshua Raymond, director at online investment platform XTB.com, comments:

“This is the fastest pace of house price declines since June 2020, during the height of the first Covid lockdown. This 1.4% decline in house prices correlated strongly to the mini-budget turmoil when thousands of mortgage deals were removed from the market, and prospective buyers faced stark rises in borrowing costs. The mini-budget was an earthquake for the mortgage sector, and these price falls paint that reality in the clearest terms.

“Yet the most important aspect is whether this marks the start of a new downward trend in house prices or is it a short-term blip. There is much evidence to suggest the downward trend has begun, but perhaps we can expect shallower declines. Average mortgage rates hit their highest levels since 2014, highlighting the increase in borrowing costs. Yet with the BoE predicting that the market is overestimating the scale of prospective interest rate hikes, we might not expect borrowing costs to rise as much as initially feared in the medium term, which might help slow the pace of price declines.”

Support for new buyers may counter the UK house prices drop

Iain McKenzie, CEO of The Guild of Property Professionals, says: “November saw the biggest fall in house prices since the country was plunged deep into lockdown two years ago, but this shouldn’t come as a surprise after months of economic upheaval.

“When this happened before, the Government introduced the stamp duty holiday, giving the market the shot in the arm it needed to incentivise people to buy.

“Another version of the Help to Buy would go a long way towards giving the necessary support for first-time buyers, but it needs to be made available to all types of properties.

“Let’s not forget, though, that house prices have been growing at unprecedented levels in the last couple of years, and a slight readjustment in the market was likely to happen sooner or later.

“This cooling effect is unlikely to turn into a great freeze so long as the demand from buyers remains buoyant. We previously saw house prices drop significantly during the Global Financial Crisis. However, growth eventually returned and has sustained ever since.”

Seasonal factors may also have an influence

Speaking on the UK house prices drop, Samuel Mather-Holgate of Swindon-based advisory firm Mather & Murray Financial said: “We shouldn’t lay all the blame at Truss’s and Kwarteng’s door, but this certainly was the catalyst of an abruptly stalling housing market. A combination of rising interest rates, higher taxes and a lack of confidence has killed off any confidence in housing for the rest of the winter. Prices should fall around 20% and bottom out late Spring.”

Riz Malik, director of Southend-on-Sea-based R3 Mortgages: “Most of the purchase deals on my desk had price reductions between 5%-10% in November. This downward trend will become more apparent after Christmas when many people are going to consider their housing needs, investment yields and even their marriages.”