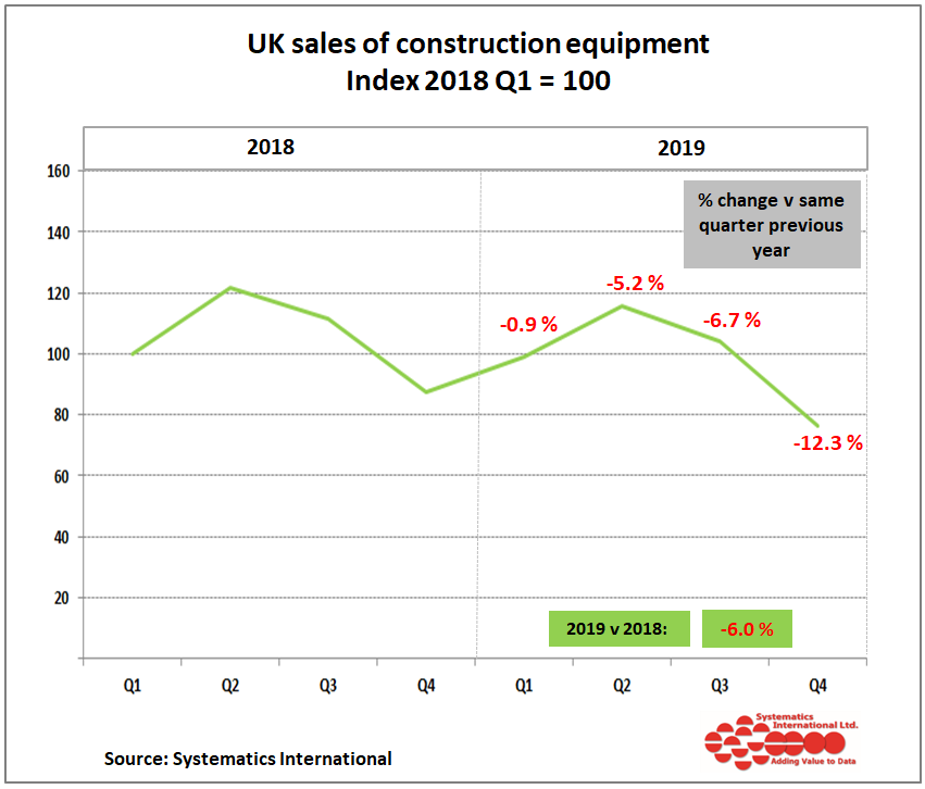

UK sales of construction and earthmoving equipment decreased by 12.3% in the final quarter of 2019, which led to sales for the whole of 2019 showing a 6% reduction

Retail sales of construction and earthmoving equipment in the UK market fell by 12.3% in the last quarter of 2019, compared with the same quarter in 2018. This continued the trend during last year of quarterly sales falling at increasing rates through the year compared with 2018.

This significant fall in construction and earthmoving equipment sales in the final quarter resulted in sales for the whole of 2019 displaying a 6.0% reduction on 2018 levels, reaching just over 32,000 units, according to the construction equipment statistics exchange, run in partnership with the Construction Equipment Association (CEA), the UK trade association.

Sales of equipment in 2019

Sales of equipment in 2019 were expected to decline after reaching a peak level in the previous year, but they have also felt the impact of market uncertainty created by Brexit and further uncertainty regarding the future of the HS2 project, and other infrastructure projects.

In the early part of 2020, sentiment within the UK equipment market does seem to be showing some signs of improvement, based on discussions at recent industry events. It is hoped that this is bringing an end to “the year of uncertainty”.

Figure 1 shows quarterly sales on an index basis from the construction equipment statistics exchange, using Q1 2018 as 100. This illustrates the downward trend compared with 2018. Previous versions of this graph showed an index based on Q1 2016, but this has been changed as a result of company participation increasing in the statistics exchange.

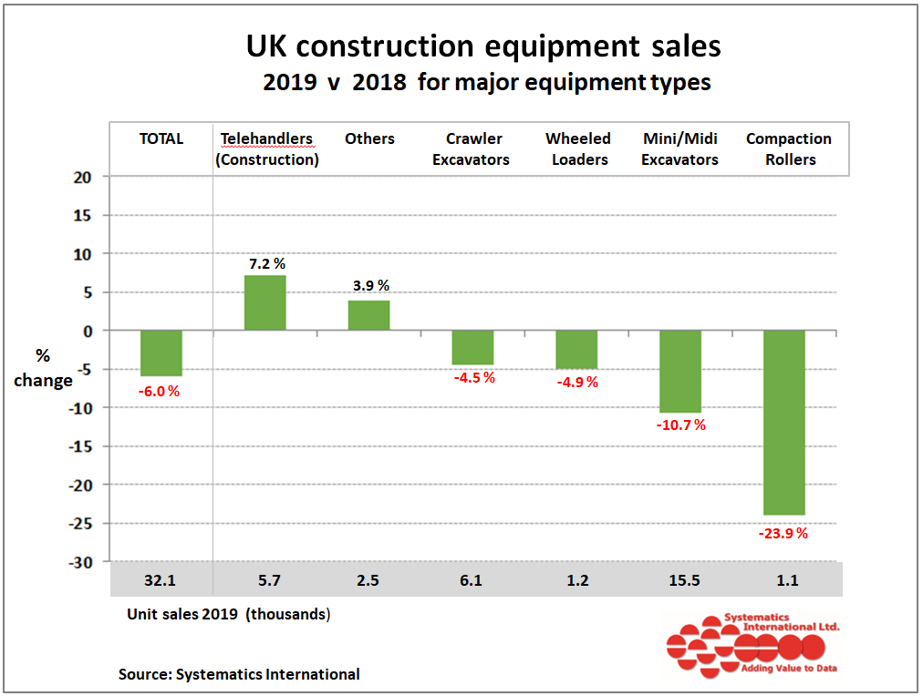

Sales by equipment type

The fall in construction and earthmoving equipment sales during 2019 was driven by two of the most popular machine types, mini/midi excavators and crawler excavators (over 10 tonnes), which showed reductions in sales of 10.7% and 4.5%, respectively (see figure 2).

Strongest sales amongst the high volume equipment types has been experienced by telehandlers (to the construction industry), which showed a 7.2% increase in 2019. This was a result of strong sales in the middle two quarters of the year.

Sales of some of the smaller volume equipment types has also been strong in 2019, as shown in figure 2 (grouped together in the ‘Others’ category), and revealed a 3.9% increase last year. This includes growth in sales of skid steer loaders, wheeled excavators and crawler dozers.