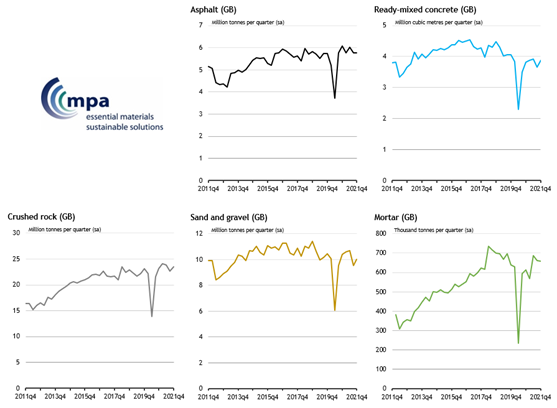

Mineral products sales of aggregates, concrete, asphalt and mortar in Britain have seen a sharp recovery following the pandemic and recorded double-digit growth during 2021

The Mineral Products Association (MPA) survey reports that volumes of primary aggregates increased by 15.7% on an annual basis in 2021, 14.1% for ready-mixed concrete, 12.5% for asphalt and 24.4% for mortar. These materials are essential to the construction supply chain because they form the foundations and structures of building projects and infrastructure schemes. MPA members supply 90% of total market demand in Great Britain.

This survey also reveals that despite unprecedented supply bottlenecks impacting progress on construction sites, cost increases and higher uncertainty due to Omicron construction demand remained strong in the final quarter of the year.

In fact, sales grew – volumes of aggregates and ready-mixed concrete grew by 3.8% and 5.9% respectively in 2021 Q4 compared to the previous quarter. Small quarterly declines were recorded in asphalt and mortar sales recorded but total demand in volume remains elevated.

Recovery

The recovery in mineral products sales last year has been faster than predicted but also imbalanced. To provide an example of this, aggregates and asphalt sales in 2021 exceeded pre-pandemic levels in 2019 but sales of ready-mixed concrete and mortar remain weaker. Demand of asphalt and aggregates was supported by an acceleration in infrastructure work, including roads and major infrastructure projects such as High Speed 2 (HS2).

Asphalt sales have maintained a historically high level of activity for the past 18 months with producers working hard to meet pent-up demand from delayed road projects due to the pandemic. Another factor is the demand stemming from Government’s Road Investment Strategy 2 and an increase in demand from local authorities for repair and maintenance work.

However, ready-mixed concrete sales in 2021 did not follow a similar story. They were 6.7% below 2019 volumes, with demand held back by the comparatively weaker recovery in new commercial tower projects. Like concrete, mortar sales in 2021 were also lower than in 2019 but a robust pipeline of new housing starts and residential building contracts looks promising and should support further growth in mortar demand this year.

‘Momentum in infrastructure will be the key driver behind… growth’

Feedback from MPA producer members at the start of 2022 indicates that Omicron has not caused major disruptions. Also, the number of positive Covid cases affecting employees was reported to have fallen back compared to the end of December.

Aurelie Delannoy, MPA director of economic affairs, expects mineral products sales volumes to continue to grow over the next two years, albeit at a slower pace than recorded in 2021. She said:

“Momentum in infrastructure will be the key driver behind that growth, assuming work continues to progress on major projects such as HS2, Hinkley Point C and Thames Tideway, and the delivery of five-year programmes in the regulated sectors matches current commitments.”

MPA forecast

It is forecasted that sales of aggregates and ready-mixed concrete will grow by 3.0% year on year in 2022, 4.0% for asphalt and 6.5% for mortar. Whilst current growth prospects are inevitably conditional on the timely delivery of the infrastructure pipeline, the mineral products sales industry is also navigating the wider potential fallout of supply chain bottlenecks on general construction activity and significant cost increases for a wide range of inputs. This includes energy, wages and carbon.

Nigel Jackson, MPA chief executive said:

“I pay tribute to our members who met every challenge head-on in 2021 by overcoming shortages, disruptions, increased costs and uncertainties and still delivered for the UK at a time when so many industries were unable to do so. Hopefully the positive prospects for the next two years will build on that success predicated on Government plans and announcements for infrastructure and ambitions for housing materialising.”

“Building confidence for members to invest in people, assets and resources to ensure demand is supplied underpins what MPA members seek from Government.

“Mineral products remain the largest material flow in the economy and their supply should not be assumed given the constraints imposed by the current planning and permitting systems and the cumulative costs and impacts of the regulatory environment and poor implementation which just seems to get worse. Government statements on cutting red tape are hollow and it is time that real action was taken to boost the industry’s competitiveness.”

Figure 1. Mineral products sales volumes in Great Britain

Table 1. MPA sales volumes in GB: change on the previous period (seasonally adjusted)

| Asphalt | Ready-mixed concrete* | Crushed rock | Sand & Gravel | Mortar | |

| 2019 | -0.8% | -3.9% | -0.7% | -5.4% | -2.3% |

| 2020 | -8.6% | -18.2% | -9.6% | -12.4% | -23.5% |

| 2021 | 12.5% | 14.1% | 16.7% | 13.3% | 24.4% |

| 2021Q1 | -4.9% | 1.6% | 4.1% | 1.9% | -7.4% |

| 2021Q2 | 4.5% | 1.2% | -0.9% | 0.9% | 21.2% |

| 2021Q3 | -4.3% | -6.7% | -4.8% | -10.7% | -3.7% |

| 2021Q4 | -0.3% | 5.9% | 3.4% | 4.9% | -0.7% |

| 2021 vs. 2019 | 2.8% | -6.7% | 5.6% | -0.8% | -4.7% |

*Ready-mixed concrete sales volumes at GB level cover sales from both fixed and site (mobile) plants.

Source: MPA, ONS.