Nationwide’s House Price Index for May shows annual house price growth slipping back to -3.4% after April’s -2.7%

Annual house price growth was not the only indicator of the market stumbling, as May’s HPI also found a 0.1% month-on month fall in house prices.

The annual house price growth drop is the highest since July 2009’s 6.2% fall after the 2008 financial crisis.

According to Nationwide, the average UK house price was £260,736, 4% below the August 2022 peak of £273,751.

Commenting on the figures, Robert Gardner, Nationwide’s Chief Economist, said:

“Following tentative signs of improvement in April, annual house price growth softened again in May, falling back to -3.4% (from -2.7% in April).

“However, this largely reflects base effects with prices broadly flat over the month after taking account of seasonal effects. Average prices remain 4% below their August 2022 peak.

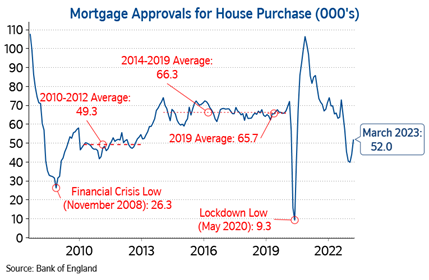

“Recent Bank of England data had shown some signs of recovery in housing market activity, although the number of mortgages approved for house purchase in March was still around 20% below pre-pandemic levels.

“Moreover, headwinds to the housing market look set to strengthen in the near term. While consumer price inflation did slow in April, it was a much smaller decline than most analysts had expected.

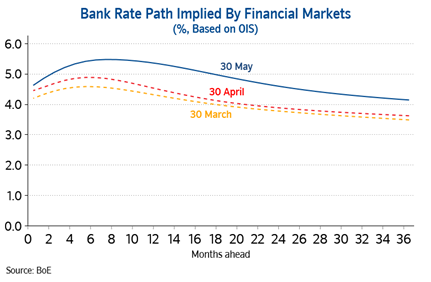

“As a result, investors’ expectations for the future path of Bank Rate increased noticeably in late May, suggesting it could peak at c5.5%, well above the c4.5% peak that was priced in around late March. Furthermore, rates are also projected to remain higher for longer (see chart below).

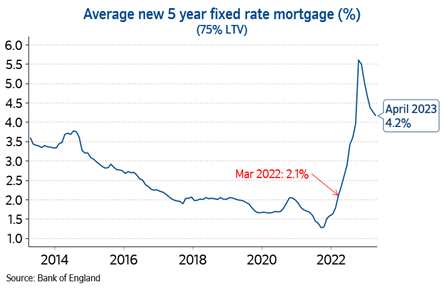

“If maintained, this is likely to exert renewed upward pressure on mortgage rates, which had been trending down after spiking in the wake of the mini-Budget in September last year (see chart below).

Former RICS residential chairman Jeremy Leaf observed that “the figures reflect what was happening not just after the mini-Budget in September when so much activity paused but also the improvements since”.

He added: “Continuing worries about the cost of living highlighted in the recent core inflation numbers are compromising confidence and having a knock-on effect on mortgage cost and availability, inevitably leading to a softening of property prices.”

Gentle optimism was encouraged for future house price growth

Managing director of estate agents Barrows and Forrester James Forrester predicted that this underwhelming market would continue for a while.

“Those sitting on the fence in anticipation of a return to the pandemic glory days of double-digit price growth will be sitting for some time.

“However, the outlook is broadly positive and, while a natural correction was always likely, we are yet to see any inkling of a market crash.”

Robert Gardner continued: “Nevertheless, in our view a relatively soft landing remains the most likely outcome since labour market conditions remain solid and household balance sheets appear in relatively good shape.

“While activity is likely to remain subdued in the near term, healthy rates of nominal income growth, together with modestly lower house prices, should help to improve housing affordability over time, especially if mortgage rates moderate once Bank Rate peaks.”

You can read more about Nationwide’s House Price Index reports here.